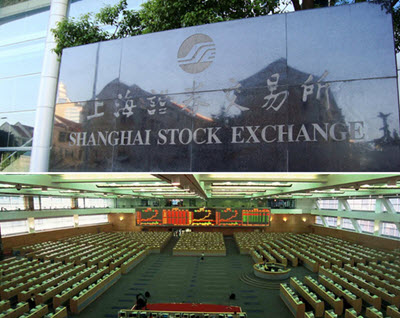

Shanghai was the first city in China to see stocks, stock trading, and stock exchanges as early as 1860s. It took until 1929 before the Shanghai Stock Market was officially formed. Now Shanghai is one of the biggest markets in the world and is the financial center of the Far East. In this introduction into the Shanghai Stock Exchange (SSE) we will discuss the history and the workings of this exchange and provide you with the information you need to figure out if this is the market for you.

How did it all begin?

The origins of SSE traces back to 1920 when the Shanghai Securities and Commodities Exchange was established, followed by the Shanghai Chinese Merchant Exchange. After 8 years these two markets combined to form what we today call the Shanghai Stock Market. In 2 different times of war the SSE was closed down, only to be reopened finally in November 2nd in 1990.

The origins of SSE traces back to 1920 when the Shanghai Securities and Commodities Exchange was established, followed by the Shanghai Chinese Merchant Exchange. After 8 years these two markets combined to form what we today call the Shanghai Stock Market. In 2 different times of war the SSE was closed down, only to be reopened finally in November 2nd in 1990.

After 28 years of consistent growth, SSE has developed into a comprehensive exchange with stocks, bonds, funds, and derivatives products, a world-class exchange system, communication infrastructure and an effective self-regulatory system.

What about today?

Today the largest stock exchange in mainland China, The Shanghai Stock Exchange is a non-profit organization run by the China Securities Regulatory Commission. Due to the tight capital account controls exercised by the Chinese mainland authorities, the Shanghai Stock Exchange is still not entirely open to foreign investors. Two main classes of stock for every listed company are traded on the exchange: A-shares and B-shares. A-shares are quoted in Yuan, and are only made available to foreign investors through a qualified program known as QFII. B-shares are quoted in US Dollars and are generally open to all Chinese and foreign investors.

SSE list is quite extensive, with 1,412 companies, 11,458 securities, and 1,456 stocks. With $4.27 Trillion in market capitalization, the SSE is 4th largest stock exchange in the world. With a population of 1.33 billion people and a GDP of $9.33 Trillion Adjusted US Dollars the ratio of Market Cap over GDP is 45.81%.

SSE is open each day from 9:30 – 11:30 AM and 1:00 – 3:00 PM Asia/Shanghai time zone.

Is it the Right Choice for YOU?

The SSE is a stock exchange that experiences continuous rises and falls. This is caused by some factors like: limit up limit down restrictions, ban on short sales, and the ban on intraday trading. Even though this allows for some people to benefit greatly from these short gains and losses it does at the same time open the door for instability and uncertainty in investing in the market itself. Within China, SSE is the right way to go, but for foreign investors, other markets and exchanges may provide a more stable and easier trading environment. So make sure you are aware of all the risk and gain factors SSE presents before investing and use the information in this article along with doing your due diligence, to make an informed decision.